how much is inheritance tax in wv

Ad The Leading Online Publisher of National and State-specific Probate Legal Documents. Other heirs pay 15 percent tax as a flat rate on all inheritance received.

West Virginia Estate Tax Everything You Need To Know Smartasset

Paying for the funeral and burial of your loved one.

. Inheritance tax returns are usually due within one year and some states offer discounts for filing earlier. Other heirs pay 15 percent tax as a flat rate on all inheritance received. Technically it can happen in two cases.

However state residents must remember to take into account the federal. That means if you inherit property either real property personal property or intangible property like financial accounts or cash you will not have to pay an inheritance tax in WV West Virginia inheritance tax on the value of the inherited property. Generally West Virginia has a relatively low tax burden.

The focus of estate taxes is on the value of a dead persons assets and whether it exceeds the estate tax threshold. The advantages of an inheritance cash advance in West Virginia include. No need to go through a loan approval process.

The top estate tax rate is 16 percent exemption threshold. An immediate influx of cash. In Washington State there is no inheritance tax.

In 2021 federal estate tax generally applies to assets over 117 million. Although west virginia has neither an estate tax or nor an inheritance tax the federal estate tax may still apply depending on the value of. However state residents must remember to take into account the federal estate tax if their estate or the estate they are inheriting is worth more than 1118 million.

Estate tax rate ranges from 18 to 40. No estate tax or inheritance tax. However there are certain cases when West Virginia residents may find themselves responsible for federal taxation that can reach as much as 40 of the inherited estate.

Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. There is no federal inheritance tax but there is a federal estate tax. The estate tax exemption for New York increases to 611 million while that for Washington state remains unchanged at nearly 220 million.

If you are a sibling or childs spouse you dont pay taxes on inheritance under 25000. States may also have their own estate tax. Up to 1158 million can pass to heirs without any federal estate tax although exemption amounts on state estate taxes in certain states are considerably lower and can apply even when the federal.

Iowa for instance doesnt impose an inheritance tax on beneficiaries of estates valued at 25000 or less. A few states have disclosed exemption limits for 2022. If the estate is appraised for up to 1 million more than that threshold the estate tax can be in excess of 345000.

3 on the first 10000 of taxable income. State inheritance tax rates range from 1 up to 16. Surviving spouses are always exempt.

West Virginia collects neither an estate tax nor an inheritance tax. Inheritance tax rates depend on the beneficiarys relation to the deceased and. No estate tax or inheritance tax.

There is no inheritance tax in West Virginia. Washington has the highest estate tax at 20 applied to the portion of an estates value greater than 11193000. A In generalThere is hereby imposed on the income of every individual a tax equal to the sum of 1 12 PERCENT BRACKET12 percent of so much of the taxable income as does not exceed the 25-percent bracket threshold amount 2 25 PERCENT BRACKET25 percent of so much of the taxable income as exceeds the 25-percent bracket threshold amount but does not.

If you are a spouse child parent stepchild or grandchild youll pay no inheritance tax as the entire amount is exempt. 2193 million Washington DC District of Columbia. West Virginia collects income taxes from its residents at the following rates for single head of household and married-filing-jointly taxpayers.

The chart below shows the 2021 estate taxes for 12 states and the District of Columbia as well as the expected exemption. Ad Inheritance and Estate Planning Guidance With Simple Pricing. No estate tax or inheritance tax.

56 million West Virginia. No need to go through a bank for the money. Heres a breakdown of each states inheritance tax rate ranges.

Inheritance taxes differ from estate taxes as inheritance taxes apply to the beneficiary. Most estate taxes are levied at the federal levelbut many estates arent subject to them. Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax.

The top estate tax rate is 20 percent exemption threshold. Any estate worth more than 118 million is subject to estate tax and the amount taken out goes on a sliding scale depending on how much more than 118 million the estate is worth. Like most states there is no West Virginia inheritance tax.

Based on the value of the estate 18 to 40 federal estate tax brackets apply. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only imposes the tax on inheritances over 50000. 13 rows West Virginia Inheritance and Gift Tax.

The Economic Growth and Tax Relief Reconciliation Act of 2001 has also eliminated the estate tax in West Virginia. Charitable and nonprofit organizations dont pay a tax if the amount is less than 500 but 10 percent of anything over the amount. Distant family and unrelated heirs pay between 10 and 15 percent of the value of the inheritance.

How estate taxes work. Paying for the fees associated with the West Virginia probate process. West Virginia collects neither an estate tax nor an inheritance tax.

An inheritance tax requires beneficiaries to pay taxes on assets and properties inherited from a deceased person. Anyone else pays inheritance tax of 0 16 but in New Jersey domestic partners are exempt too. While it might not have zero income tax like Nevada or no sales tax like Oregon its rates generally are so low that the benefits to taxpayers are actually similar or even better than in those states.

As of 2021 only estates worth more than 117 million are taxed and only on the amount that exceeds that number.

A Guide To West Virginia Inheritance Laws

Do I Pay Taxes On Inheritance Of Savings Account

A Guide To West Virginia Inheritance Laws

A Guide To West Virginia Inheritance Laws

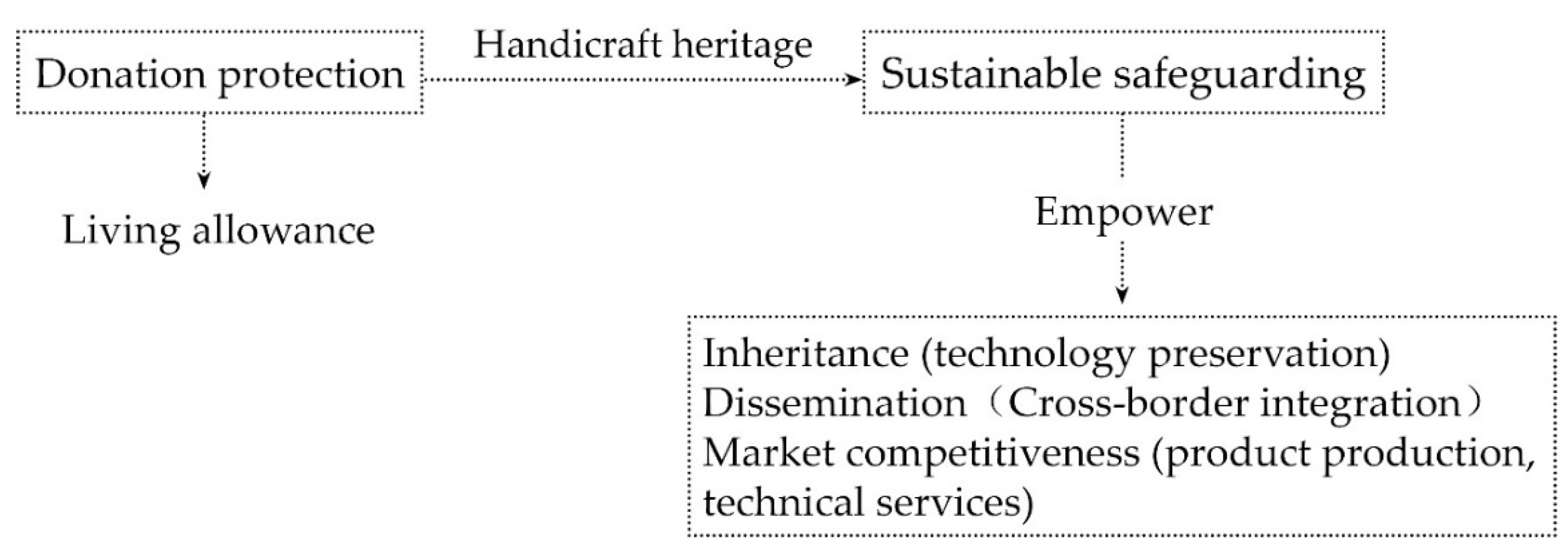

Sustainability Free Full Text The Safeguarding Of Intangible Cultural Heritage From The Perspective Of Civic Participation The Informal Education Of Chinese Embroidery Handicrafts Html

Sleeping With My Dead Husband S Brother The Impact Of Hiv And Aids On Widowhood And Widow Inheritance In Kampala Uganda

West Virginia Estate Tax Everything You Need To Know Smartasset

Do I Have To Pay Pennsylvania Inheritance Tax If My Relative Lives In Another State

States With No Estate Tax Or Inheritance Tax Plan Where You Die

A Short Guide To West Virginia Inheritance Tax Blog Jenkins Fenstermaker Pllc

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Do I Transfer Ownership Of An Inherited Property

What Happens When You Inherit A House Home Sellers Guide

Claiming Inheritance In India Applicable Laws And Processes Inheritance India Law Firm

A Short Guide To West Virginia Inheritance Tax Blog Jenkins Fenstermaker Pllc

A Guide To West Virginia Inheritance Laws

Is There A Federal Inheritance Tax Legalzoom Com

What Is Inheritance Tax Who Pays How Much Sydney Wills Lawyer

The 35 Fastest Growing Cities In America City Houses In America Murfreesboro Tennessee