how to become tax exempt at home depot

If you qualify as a tax exemptshopper and already have state or federal taxIDs register online for a Home Depot tax exemptID number. Please print out and complete the following tax exempt application and attach any applicable state specific.

Tax Exempt Purchases For Professionals At The Home Depot

Sign In Update Tax Exemption.

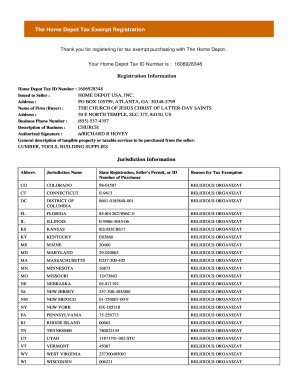

. Use your Home Depot tax exemptID at checkout. The Home Depot Tax Exempt ID number is used when making tax exempt purchases in lieu of the state issued tax exempt ID number. Use your home depot tax exempt id at checkout.

For more information please refer to the Form 1024 product page. The method of payment is listed next along with the last four digits of your credit card number the type of card used if this was your method. Sign in with the business account you will be making tax exempt purchases with.

Utilize a check mark to point the choice where demanded. Let us know and well give you a tax exempt ID to use in our stores and online. Easily follow these steps and start dropshipping using Home De.

A hold-your-hand video that will help you gain tax exemption from Home Depot. Establish your tax exempt status. Home Depot Tax Exemption Document Created Date.

Home Depot Tax Exemption Document Author. Your Home Depot Tax ID Number. The number is auto assigned by the system during the registration process.

No need to register. Find the document you want in our library of legal templates. To complete the form you will be asked about your business and about the reason for the exemption.

As of January 3 2022 Form 1024 applications for recognition of exemption must be submitted electronically online at wwwpaygov as well. What is exempt from sales tax in Iowa. Mailing Address TAX DEPARTMENT.

Read through the recommendations to determine which info you will need to give. Use your Federal Government Purchase Card at checkout. The most secure digital platform to get legally binding electronically signed documents in just a few seconds.

Open the form in the online editor. All of the above forms are available on the ohio department of taxation website. Enter your business information and click Continue.

The required fields are marked with red asterisk marks. FOR OFFICE USE ONLY Store COMPANY INFORMATION please print clearly MAILING ADDRESS If dierent from above Email Address COMMUNICATION TAX INFORMATION Last Name To be approved for a tax exemption purchasing card. The Home Depot Tax Exempt Registration Thank you for registering for tax exempt purchasing with The Home Depot.

Establish your tax exemptstatus. Discover home depot tax exempt status for getting more useful information about real estate apartment mortgages near you. How Does It Work.

No need to register. If you qualify as a tax exempt shopper and already have state or federal tax IDs register online for a Home Depot tax exempt ID number. Once youre approved shop in our stores or online and simply provide.

Here it is guys. How to get a tax exempt certificate will vary by state and will depend on the type of certificate you want to obtain. The Home Depot Inc.

To obtain a home depot tax exempt id number you must register to receive one on home depots website. Use your Federal Government Purchase Card at checkout. Keep to these simple instructions to get Home Depot Tax Exempt ready for sending.

Mailing Address TAX DEPARTMENT. Please mail the original nontaxable. If you qualify as a tax exempt shopper and already have state or federal tax IDs.

Use your Home Depot tax exempt ID at checkout. And select your particular state or contact the Oce Depot Tax Exempt Department at 800-848-8100. To obtain a Home Depot Tax Exempt ID number you must register to receive one on Home Depots website.

If you qualify as a tax exempt shopper and already have state or federal tax ids register online for a home depot tax. Click to see full answer. You may apply for sales tax exemption with Office Depot by executing the following steps.

Tax Exempt The Home Depot Register Tax Exemption Are you a tax exempt shopper. Establish your tax exempt status. Use your Home Depot tax exempt ID at checkout.

Go to the Home Depot Tax Exempt Registration Page in your web browser see Resources. A grace period will extend until April 30 2022 where paper versions of Form 1024 will continue to be accepted. Select the fillable fields and put the necessary data.

If you have any questions about Home Depot Tax Exemption please call The Home Depot Tax Department at 877 434-6435 Option 4 Option 6. If you have any questions about Home Depot Tax Exemption please call The Home Depot Tax Department at 877 434-6435 Option 4 Option 6. The ID number will be numeric only and is displayed on the printed registration document.

According to NM regulations copies are not acceptable.

Tax Exempt Purchases For Professionals At The Home Depot

Top 30 Recommended Retail Stores For Online Sourcing In 2022 The Selling Family Online Arbitrage Retail Arbitrage Drop Shipping Business

In Depth Analysis Of The Esbi Model Financial Motivation Savings And Investment Finance Career

How To Find Home Depot Tax Id Fill Online Printable Fillable Blank Pdffiller

Barnett The Home Depot Pro Specialty Trades Electrical Hvac And Plumbing Supplies The Home Depot Pro Specialty Trades

How Do I Get A Home Depot Tax Exempt Id Number

Home Office Business Expenses Deduction Only Home Depot Business Tax Exempt Study Motivation Quotes Entrepreneur Quotes Inspirational Quotes Motivation

Digital Marketing How To Choose The Right Niche Cashflow Quadrant Investing Books Investing Money

Wilmar The Home Depot Pro Multifamily Maintenance Repair And Operation Supplies The Home Depot Pro Multifamily

Requirements For Tax Exemption Tax Exempt Organizations

Tax Exempt Purchases For Professionals At The Home Depot

Home Depot Tax Exemption Application Youtube

Home Depot Tax Exempt Fill Online Printable Fillable Blank Pdffiller

How Do I Get A Home Depot Tax Exempt Id Number

Home Depot Tax Exemption Application Youtube

Have You See Robert Kiyosaki S Cashflow Quadrant It S Here Learn Earn Robert Kiyosaki Kiyosaki